- #POWER OF ATTORNEY FOR FINANCES ONTARIO FORM HOW TO#

- #POWER OF ATTORNEY FOR FINANCES ONTARIO FORM PROFESSIONAL#

#POWER OF ATTORNEY FOR FINANCES ONTARIO FORM HOW TO#

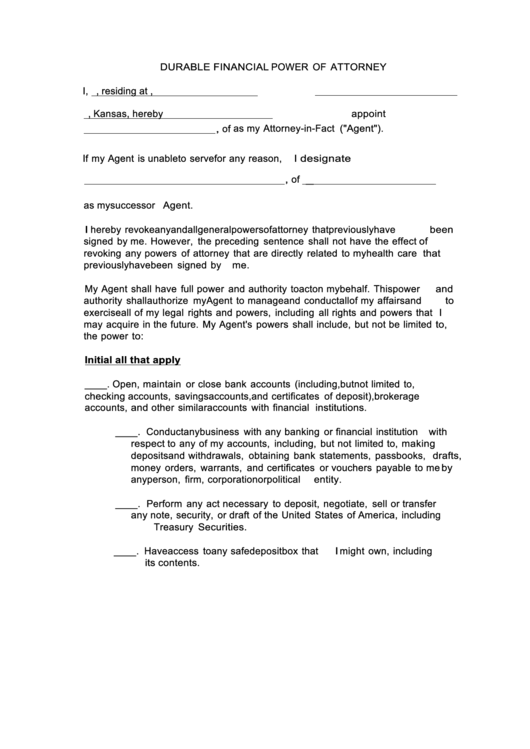

Next find out How To Activate Power of Attorney in Ontario. This is called “co-decision making,” and it allows for joint decision-making between two or more people. In some cases, more than one person may be appointed as a substitute decision-maker. They can also give or refuse consent to certain types of legal proceedings on behalf of the principal. A substitute decision-maker has the authority to make decisions about the personal care and welfare of the principal, including decisions about medical treatment and living arrangements. The powers of a substitute decision-maker are set out in Ontario’s Substitute Decisions Act. An organization can be a hospital, long-term care home, or any other care facility where the principal resides. An individual can be a spouse, partner, adult child, parent, grandparent, close relative, friend, or any other person the principal trusts to make decisions on their behalf. The principal must appoint their substitute decision-maker in writing, and the appointment must be witnessed by two people unrelated to the principal or the substitute decision-maker.Ī substitute decision-maker can be either an individual or an organization. In Ontario, a substitute decision-maker can be appointed by the person with the capacity (the “principal”) to make decisions on their behalf. There are different types of substitute decision-makers, each with its own rules and responsibilities.

#POWER OF ATTORNEY FOR FINANCES ONTARIO FORM PROFESSIONAL#

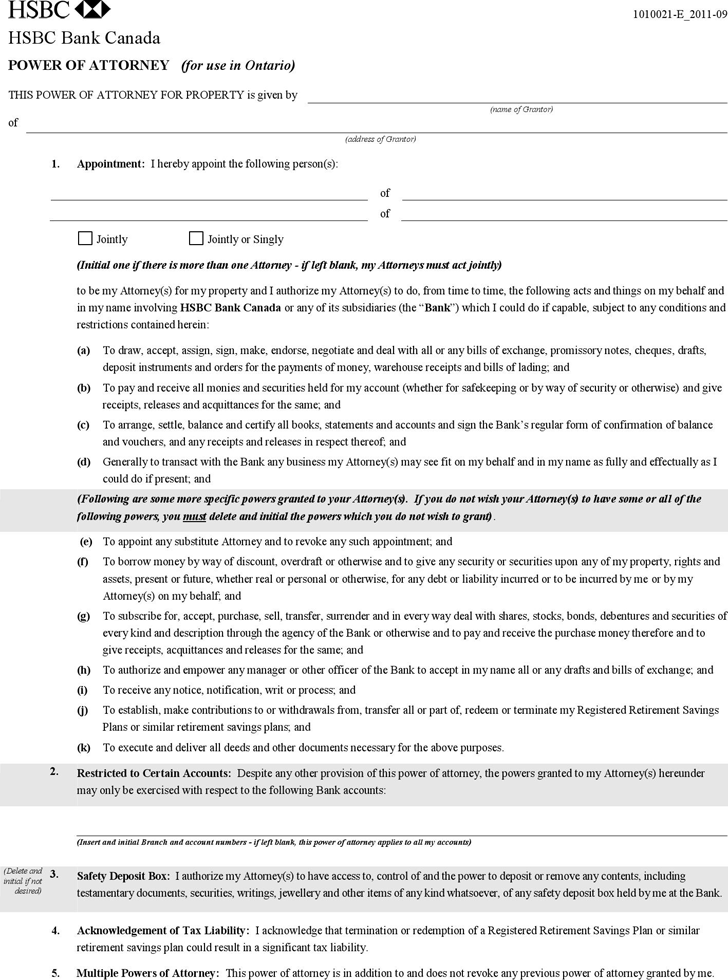

When executing the steps on How To Activate Power of Attorney in Ontario, always ask a legal professional for help in any way. This can be challenging, so you must understand the responsibilities before agreeing to take on this role. If the principal becomes incapacitated or unable to make decisions for themselves, a power of attorney will allow you to step in and make decisions on their behalf. For example, a principal could give you power of attorney for financial matters, not personal ones. The person who gives you power of attorney is called the “principal.” The principal can provide you with as much or as little energy as they want and specify the decisions you can make. This can include financial decisions, such as paying bills or selling property, or personal choices, such as medical treatment or living arrangements. When someone gives you power of attorney, they give you the legal authority to make decisions on their behalf.

If your power of attorney deals with real property, you must sign the amendment in the presence of a lawyer or notary, and the lawyer or notary must also sign.Keep on reading to find out How To Activate Power of Attorney in Ontario. You and your attorney do not have to sign at the same time. The attorney must also sign the amendment in front of two witnesses. You need only one witness if the witness is a notary public or a lawyer. The witnesses must also sign and date the amendment in front of you. You must sign and date the amendment and have the signing witnessed by two witnesses. You must sign the amendment with a handwritten signature. For example, if you are changing an enduring power of attorney:

Consider asking a lawyer or notary to draft the amendment for you.Īn amendment should be signed and witnessed in a certain way. This is a separate document, that refers to the original power of attorney, and sets out the changes to be made. A formal change to a legal document is called an amendment. If you want to make changes to your existing power of attorney document, there are certain rules you must follow.

0 kommentar(er)

0 kommentar(er)